Coinbase Ventures Portfolio Overview

Coinbase Ventures is making significant waves in the investment landscape by backing a diverse range of startups primarily focused on cryptocurrency and blockchain technologies. The

Coinbase Ventures portfolio is strategically curated to tap into market innovations that align with Coinbase’s mission of expanding economic freedom through the power of decentralized finance. Some notable investments include ventures in promising fintech and supply chain solutions. The

Coinbase Ventures portfolio reflects a forward-thinking approach, embracing cutting-edge technologies to shape the future of decentralized applications and services.

Significance of AI in 2025

As we approach 2025, the role of Artificial Intelligence (AI) is set to become even more pivotal across various sectors, including finance, healthcare, and entertainment. AI technologies are expected to transform how businesses operate, leading to enhanced efficiency, increased productivity, and improved decision-making processes. Here’s why you should pay attention:

- Automation of Tasks: Streamlined operations will allow businesses to focus on growth.

- Data Insights: AI’s ability to analyze vast amounts of data can improve forecasts and strategies.

- Personalization: Enhanced customer experiences will foster stronger relationships between businesses and consumers.

Investing in AI-driven technologies is not just an opportunity; it’s a necessity for future-proofing your portfolio. Interestingly, the

Coinbase Ventures portfolio has started integrating AI technologies to complement its blockchain-based projects, creating synergy between two transformative fields.

Understanding Coinbase Ventures

Background and Mission of Coinbase Ventures

Coinbase Ventures is the investment arm of

Coinbase, designed to support early-stage cryptocurrency and blockchain startups. Its mission? To propel innovative projects that align with Coinbase’s vision of expanding economic freedom in the digital landscape. By investing in a diverse portfolio, the

Coinbase Ventures portfolio fosters the growth of technologies that shape the future of finance, enabling a new era of decentralized applications and services. This strategic approach ensures that the

Coinbase Ventures portfolio remains at the forefront of innovation in the blockchain space.

Investment Philosophy and Criteria

When considering investments, Coinbase Ventures follows a disciplined approach aimed at identifying transformative innovations in the crypto space. Here’s a glimpse of their investment philosophy:

- Focus on Early-Stage: Primarily targets startups in the seed and Series A stages.

- Technology-Centric: Emphasis on projects that leverage blockchain technology effectively.

- Founder Track Record: Preference for teams with a strong background in tech or finance, ensuring the capability to execute their vision.

By adhering to these criteria, Coinbase Ventures seeks to cultivate a vibrant ecosystem that energizes the future of Web3 and crypto technologies. The

Coinbase Ventures portfolio serves as a blueprint for investors aiming to identify high-potential blockchain projects.

Read More:

real estate investing for beginners – How I Make 1,000,000 from Stocks ( New & Full Guide)

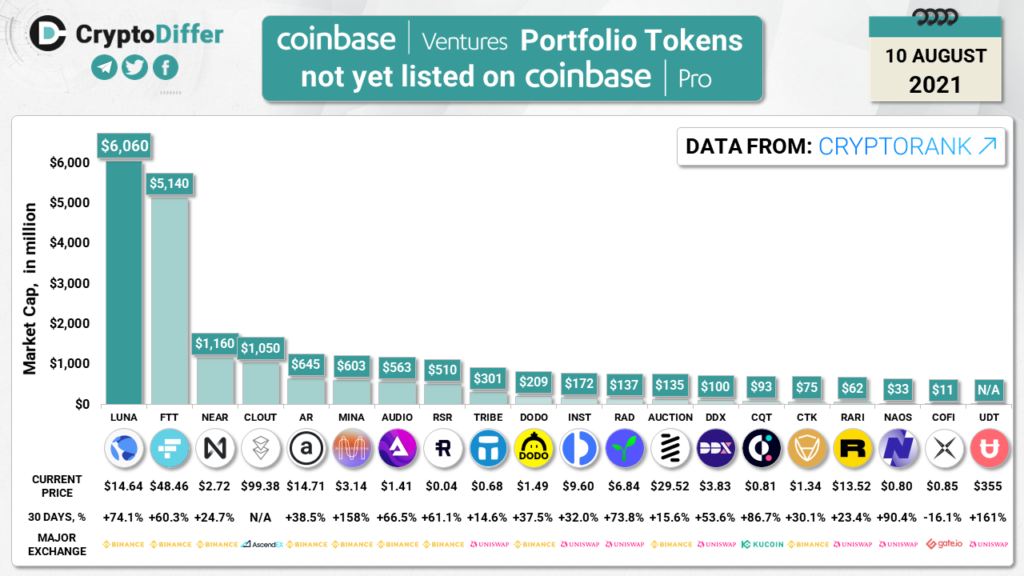

Exploring the Portfolio Companies

Overview of AI-Focused Investments

The

Coinbase Ventures portfolio has actively invested in a spectrum of AI-focused startups, recognizing the transformative potential these technologies hold. From decentralized finance solutions to AI-driven financial analytics, the aim is clear: to integrate AI innovations into cryptocurrencies and blockchain ecosystems. This commitment to AI allows investors to tap into a rapidly evolving segment, solidifying the

Coinbase Ventures portfolio as a leader in adopting cutting-edge technologies.

Success Stories and Notable Startups

Among the standout successes in the

Coinbase Ventures portfolio are companies that have made significant impacts in the AI and crypto landscapes:

- Bittensor: This innovative platform has seen its value soar by 550% in the past 18 months, establishing itself as a leading AI cryptocurrency.

- Audius: This decentralized music streaming service empowers artists through blockchain and AI technologies, offering a fairer revenue model.

These successes highlight the immense growth opportunities within the AI-driven crypto sector and underscore the value of Coinbase Ventures’ strategic focus. The

Coinbase Ventures portfolio demonstrates how a forward-looking investment strategy can unlock transformative potential in both blockchain and AI.

Impact of AI on Finance and Investments

Role of AI in Transforming Financial Markets

Artificial Intelligence is revolutionizing financial markets in numerous ways. From algorithmic trading that analyzes vast datasets to predictive analytics that help investors make well-informed decisions, AI’s applications seem endless. For instance, AI-driven trading platforms can process information in real time, identifying trends and executing trades faster than any human trader. This speeds up market responses and reduces inefficiencies. The

Coinbase Ventures portfolio leverages these advancements to drive innovation in blockchain-based financial markets.

Opportunities for Investors in AI-Driven Companies

Investing in AI-focused companies presents exciting opportunities for growth. Many organizations leverage AI to enhance customer experience, streamline operations, or offer innovative financial products. Here are some areas ripe for investment:

- Algorithmic Trading Firms: With AI’s advanced data processing capabilities, these firms are set to outperform traditional methods.

- Fintech Startups: These companies are using AI to disrupt banking, offering personalized financial services and improved customer support.

The

Coinbase Ventures portfolio exemplifies how AI can transform crypto and finance, presenting a clear path for savvy investors to leverage this synergy. By incorporating AI-driven technologies, the

Coinbase Ventures portfolio ensures long-term relevance and growth in the rapidly evolving tech landscape.

Strategies for Investing in AI in 2025

Diversification Within the AI Sector

As the AI landscape evolves, diversifying your investments across various sub-sectors can be a smart strategy. By spreading your investments, you minimize risk while capitalizing on different growth areas. Consider:

- AI in Healthcare: Look for startups focusing on diagnostic technologies and patient management.

- AI in Finance: Invest in platforms using AI for algorithmic trading or financial advising.

Having a mix will enhance your chances of benefiting from AI breakthroughs, especially when aligned with innovative portfolios like the

Coinbase Ventures portfolio.

Long-Term Investment Approach for Sustainable Returns

A long-term investment approach is essential for capitalizing on the transformative potential of AI. Here’s how to ensure sustainable returns:

- Focus on Quality Startups: Prioritize companies with solid fundamentals and innovative AI applications.

- Stay Informed: Regularly update yourself on industry trends and advancements to make informed choices.

By remaining patient and thoughtful in your investment strategy, you position yourself for significant rewards as AI technology matures and expands. The

Coinbase Ventures portfolio serves as a valuable reference for identifying high-growth potential in emerging technologies.

Risks and Challenges in AI Investing

Regulatory Concerns and Ethical Considerations

Investing in AI comes with various regulatory and ethical challenges that potential investors should weigh carefully. As governments around the world draft regulations around AI usage, your investments could face scrutiny or operational limits. Personal data protection, algorithmic transparency, and potential biases in AI systems are critical considerations. The

Coinbase Ventures portfolio navigates these challenges by aligning with projects that emphasize compliance and ethical innovation.

Market Volatility and Technological Risks

In addition to regulatory concerns, market volatility and technological risks are inherent in AI investments. AI industries are subject to rapid changes in public perception and market demand. For instance, emerging competitors or disruptive technologies can quickly erase market share. Moreover, fluctuations in the crypto market, as witnessed with Bittensor’s recent rise and fall, exemplify the volatility present in AI-related assets. As an investor, remaining adaptable is key, and the

Coinbase Ventures portfolio provides a balanced approach to mitigating such risks.

Future Trends and Predictions

Forecasting the Growth of AI Technology

The future of AI technology looks incredibly promising, with continued advancements expected to revolutionize various industries. As companies increasingly adopt AI, we can anticipate:

- Enhanced Automation: More tasks will be automated, increasing efficiency across sectors.

- AI Integration: Businesses will integrate AI into existing systems, streamlining operations.

This growth is likely to fuel demand for AI solutions and expand untapped markets. The

Coinbase Ventures portfolio is well-positioned to capitalize on these trends, integrating AI innovations into blockchain technologies.

Potential Investment Avenues in Emerging AI Fields

As AI evolves, several promising investment avenues are emerging:

- AI in Healthcare: Telemedicine and predictive analytics are set to transform patient care.

- AI-Powered Financial Services: Look for startups utilizing AI for fraud detection and personalized banking experiences.

By keeping an eye on these sectors, investors can position themselves to benefit from the next wave of AI innovations and developments. The

Coinbase Ventures portfolio offers valuable insights into navigating these emerging opportunities.

Conclusion and Key Takeaways

In summary, the

Coinbase Ventures portfolio exemplifies how strategic investments can foster innovation in blockchain and AI technologies. With a focus on early-stage startups and transformative projects, Coinbase Ventures is well-positioned to drive the future of decentralized finance and AI integration.

For investors looking to capitalize on these opportunities, following trends in both AI and

blockchain—especially within established portfolios like that of Coinbase Ventures—can offer substantial growth potential. By leveraging the insights from the

Coinbase Ventures portfolio, investors can navigate the complexities of modern tech investments with confidence and foresight.